Home → fancy clothes → The world thus choos...

The world thus choose the big brands where to locate their stores

Knowing where to open your new stores is key to signatures.They usually have specialized departments and take years to find the ideal site

For brands, being at the right place is one of the most important things if you want to sell and differentiate themselves from the rest.Finding the place where you want to place a new store is almost as important as looking for a house to live in, although the process, in the case of a fashion firm, can last much longer and negotiations are usually more complex.

"When opening a physical store, a company looks for two things: visibility and traffic of people," summarizes Luis Lara, fashion and distribution expert of the KPMG consultant.According to him, he details, more brand, the greater the need for visibility, that he is seen. "

This point also has to be transit zone: «Fashion has a lot of impulse purchase and, therefore, it is important to be in a commercial artery, on the right sidewalk, in the right corner.In a place where many people pass ... », says the specialist.

Gosia Pajowska, an expert in fashion and communication responsible for the Multimarca Zocoh platform, explains that cities "have two zones, A and B, which are commercially more effective for the traffic they have."

Once the brand has defined the street where they want to place their store, look at the exact point.It imports the number of windows that the space has, if it is done on the corner (this scores more) or how many meters of facade it has.Details are also valued as if the store is "next to a traffic light or just at the exit of Metro's mouth," says Lara.

Draw a plan

«The brands start from a Business plan based on which they choose the place to settle.The key to every operator is to determine to which audience is addressed, what type of consumer buys your product, since it will be this information that determines in which area it should be located, ”says Sergio Fernandes, director of the purchasing area of the JLL consultant, specializedin the management of commercial premises.

As he explains, «in the world of commercial premises each brand has a different strategy and, therefore, there are no common criteria to all to look for its ideal location, with the exception of a maximum that every operator shares: to be located in a streetWith a large influx of public, because the more people pass, the more possibility of increasing sales ».

Depends on the country

Finding the location for the openings of new stores is one of the keys in the strategy of fashion brands.They usually have specialized departments and may take years to find the ideal place.

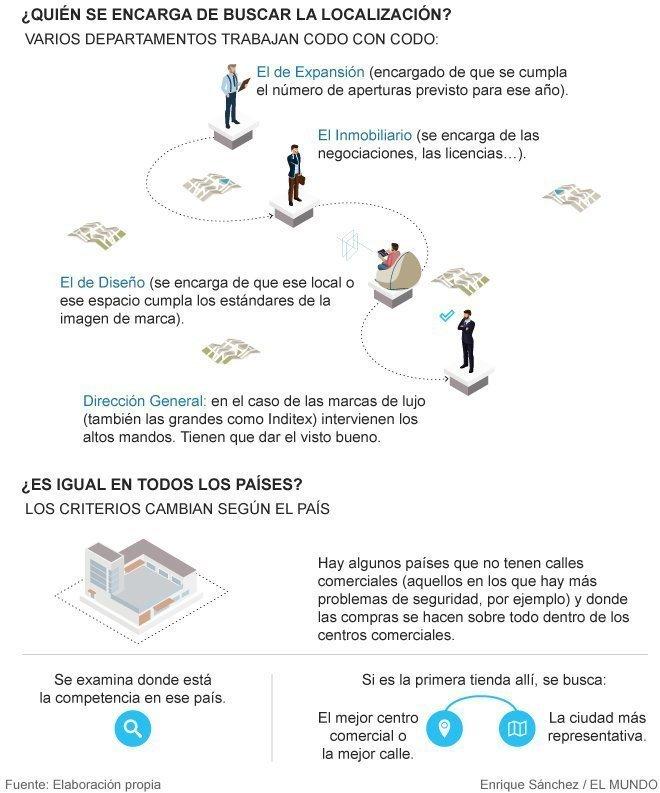

The criteria changes depending on the country.Luis Lara explains that there are some in which there are no commercial streets as we understand them in Europe, for security issues, for example, and where the purchase flow occurs inside the shopping centers.

In these countries brands are looking for the best shopping center.They take care of studies to determine the ideal because "when it is your first store you have to hit."

A needle in a hay

This search process can last for years, according to the experts consulted.Sometimes a brand passes to a five years fighting to get a place that had signed and, in the end, it fails to rent it.How to look for a needle in a haystack.

A specialist in the sector cites the case of Ralph Lauren, who spent a lot of time trying to find the ideal place to open a store in Barcelona and, in the end, he did not get it.

«Dior cost his own space on the Paseo de Gracia», which was previously the premises of Pronovias, explain sources from the fashion sector.Louis Vuitton was looking for a good corner in Madrid and had to be patients to get the space, "manage it with the owners of the building, talk to the tenants ...", says an expert who followed the process.

As these sources explain, this negotiation sometimes includes relocating other premises."They often pay for it, compensate for tenants or assume the rehabilitation works of the entire building to content the neighbors," says an expert.

«The more demanding you are, the more you will need.Luxury has time and can wait.For other brands, finding the site is more urgent and they have to relax the demands, ”they explain in KPMG.

Cases of failure and success

The specialists consulted cite examples of success and failure.An expert indicates the case of Abercrombie, which “looked for the building before the location and was wrong.They wanted a palatial environment, they found it on Ortega and Gasset street, but the location was not good because tourists are barely passing, it does not have the traffic flow that the brand needs ... ”he says.

Then there is Primark, who opened a little over a year ago his first store in the Gran Vía in Madrid and "achieved an unparalleled space."«They did very well, some shops had to be relocated and negotiated with some companies that were in the building.It was a complex project, but it was round, ”says an expert.

First store

Finding a location for the first store is more complex than when you already have open establishments from your brand and what you are looking for is to expand your presence.In the first case, explains Sergio Fernandes, the brand "will choose to look for a place of greater surface, in a representative area, where to establish its flagship (emblematic store)."In this case, "it is likely to be willing to pay more for the premises, because the objective is to obtain visibility."

If it is expanding, the strategy is different."When you have a presence in a place and want to expand it, relaxes the demands," says Lara."A brand already present in our country with different stores that you want to simply be in another area, it is likely to make the decision following cheaper criteria," says Fernandes.

The neighbors

Like when you look for a house to live, brands also look good who they have in neighbors.«The weight of the competition influences the choice of location.The signatures and sectors tend to place their stores near each other, so that the public interested in their product has different options in the same area, ”says JLL expert.

Many times companies pay to throw the neighbor, because they are not interested in being a door."They do not identify with their brand image or attract a different audience," explains a specialist.

«It is usual, when they are installed in shopping centers, negotiate with the owner to relocate to the neighboring store.These relocation processes are common, ”says Luis Lara.

The objective, says an expert, “is to attract the same audience.Inditex, for example, seeks to have close stores of his group, for example, that near Zara there is a massimo Dutti or a uterque store ».

How much

According to Fernandes, in a totally majority percentage, above 90%, companies choose the rent “for two reasons: the purchase represents a very important disbursement that will cost to recover in terms of profitability and, in addition, reduces flexibility for the future».

According to Pajowska, the brands pay for a place but, in reality, «they pay for that traffic.The most commercial streets coincide with the highest price per square meter ».

According to JLL data, the volume of investment in 2016 in commercial premises was 574 million euros.In the first quarter of 2017 it already amounts to 402 million.The monthly rental price in a commercial road can be around 50,000 euros in the case of Serrano Street.According to JLL, on precious street, in Madrid, one of the most sought -after, is between 245 and 260 euros per square meter per month.

Therefore, to know the profitability of a store it is important to assess the price paid for the premises.«You look at how much you have to sell so that the rent is approximately 15%.Although sometimes profitability is evaluated in image terms.You pay a high rent that represents more than 30% of your sales, but it is worth it because you have to be there, ”says Lara.

Who is responsible?

Each company has an expansion department that takes care of looking for the premises.They are "those in charge of meeting the objectives of openings" and those looking for the locations, explains the KPMG expert.The real estate department carries out the negotiation of the rent of the premises.

According to Pajowksa, «there everything depends on the commercial strategy of a brand: if it is committed to stores at street level or shopping centers;in addition to depending on the commercial formula (own store, rent or franchise) ».

Larger brands will almost always work with an intermediary, as these agencies usually have their own real estate portfolio.Other signatures have their own real estate.The smallest brands "will bet on their own first selection but will rent very often with a real estate," says the specialist.

The design department also participates: it is responsible for seeing that the chosen premises can be adapted to the design that the brand has in its stores."The three teams work side by side," says Lara.

In addition, the General Directorate almost usually intervenes.Sources of the sector explain that Amancio Ortega used to see all the new locations of Zara's stores.«It is a key issue.Now the stores that open will be more important, ”he adds.

Abroad companies work with local partners, especially in countries where the brand can only open under the franchise formula.This happens in Arab countries, where the law exclusively lets you do it with local partners.

Mango

In Mango, for example, they explain that the expansion teams of large brands maintain direct contact with developers and property agents, but they also walk a lot in these commercial areas to identify the flows of potential customers and the opportunities of new premises.

«We look for high traffic areas.Within the shopping centers, areas are sought that in addition to traffic have good visibility, that facilitate customer access to the store and attract potential consumers, ”they point out.

«For a large brand, these high -density areas are quite limited, since we talk about the commercial areas of each city.In addition to what already exists, it is important to know the new urban developments that can alter the commercial map of each city, ”they say.Although the price "is relevant when deciding a location, it is not a driver, but an information to be included in the store's business plan."

H&M

Its expansion strategy, they explain in the chain, is "to always be in the best locations, either at street or in a shopping center," they point out.Proof of this are the recent openings with the flagship of Paseo de Gracia, the store in the Plaza de Santo Domingo de Guzmán in Burgos or the relocation of its store at the Gloriès shopping center.

«Tenemos en cuenta aquellos factores que nos permitan ofrecer a nuestros clientes la mejor oferta comercial, y alquilamos para tener flexibilidad allá donde el cliente esté», aseguran en H&M, que dispone de un departamento interno que se encarga de la búsqueda de locales y de la estrategia de expansión.

Cortefiel

In Cortefiel they have a specialized department in both the national and international market.This is a team that "has extensive knowledge of the real estate market and interlocution with the large and small agents and owners," they point out in the group.

They explain that they always operate "based on the profitability of stores as business units within a context of location and positioning."Like almost all its competitors, they opt for rent.

Primark

In Primark they have an internal real estate management department, which "looks for adequate size stores in the appropriate locations, either in high traffic streets or in key shopping centers in Spain."

«We look at the shopping centers that already have or have the potential to have a strong market position for fashion in their collection zone.We prefer the centers that offer the client a high degree of leisure alternative, ”they explain.

VisionLab

VisionLab only has its own stores in Spain.It has no franchises.Its general director, Carlos Otero, explains that when looking for a location for a new store they carry out market studies "of the hottest areas of purchase and pedestrian passage."

«There is always a price stop.We analyze the costs of the premises based on the square meters and we see if we think it is exorbitant ».Due to its expansion model, VisionLab is an exception, as they usually buy the spaces "whenever possible", unlike many other companies, which usually opt for lease.