Home → fancy clothes → Commissions of the '...

Commissions of the 'broker' to buy shares

Choosing the broker with the lowest commissions and good service is one of the most important steps for those who choose to enter the stock market. Making the mistake of trusting the wrong platform can even lead to complete loss of money if you fall under the influence of an entity operating illegally. Therefore, it is always essential to check with the CNMV if the platform is authorized to offer investment services. Once legality is assured, it is worth asking what is the best option among the entire showcase.

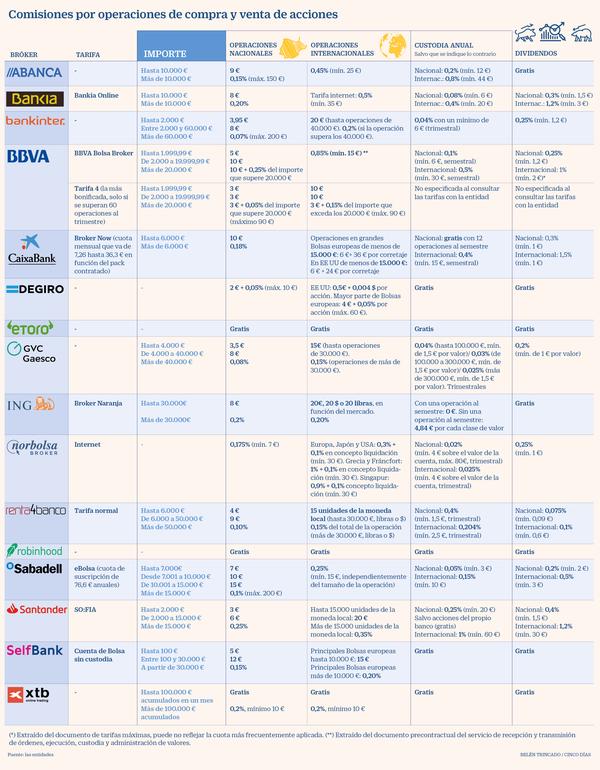

There are different ways to enter the equity market, ranging from the purchase of shares on their own account, the acquisition of shares in investment funds or derivatives operations. Each one has its peculiarities and associated commissions. The attached graph compares the fees for buying shares, without entering funds or derivatives.

Two worlds

If the different commissions for the purchase of shares are observed, today there are two very different worlds. On one side are the new online platforms, which are committed to the "free" purchase of shares. Firms such as eToro, XTB or the American Robinhood would be included in this segment. These companies choose to base their business models on other sources of income than "traditional" commissions, which does not mean that they do not charge another type. For example, in the case of the first two, they do charge a commission for withdrawing money from their platform. Specifically, eToro charges five dollars per withdrawal, while XTB asks for 20 euros if less than 200 euros are withdrawn. If the withdrawal is above that figure, it is free, as well as if it is a withdrawal to remove the remainder from the account.

Although eToro and XTB do not charge commissions directly per operation, they do include them in some of their products, such as CFDs, through the purchase and sale price of the financial asset. That is, the investor pays more when buying or selling than the market average. In the case of eToro, in BBVA shares on January 8, the spread, as the difference between the purchase and sale price is known in jargon, was 0.24%. According to Infobolsa data, the average market spread for the same day was 0.04%. A difference six times more expensive. XTB sources explain that although spreads do collect commissions on other products, this is not the case on stocks.

In the case of Robinhood, the protagonist of the movement that has mobilized minorities on Wall Street, its income comes from a premium subscription that gives access to services such as real-time data and from the sale of the execution of operations to other large firms. , which try to take advantage of economies of scale.

In the other group, intermediaries with a more traditional model, such as banks, exist, although there is a wide difference in the range of commissions charged by each of them. In the case of wanting to invest in Spanish shares, Banco Santander and BBVA have the lowest rates, charging 3 euros per operation if certain requirements are met. On the opposite side, CaixaBank and Abanca are among the most expensive with 10 and 9 euros respectively. BBVA wins again in international operations thanks to its Rate 4, the most discounted of all, which allows you to pay 10 euros per transaction.

Straddling the two worlds, there are firms like Degiro, which although they have a traditional commission model, these are lower. Specifically, in Degiro the commissions amount to 2 euros for the purchase of national securities and range between 0.5 dollars and 4 euros depending on the chosen international Stock Exchange.

Model D-6

Although it is not a commission itself, it is also an element to take into account when choosing a broker. If you own shares on a depository platform abroad, such as XTB, eToro or Degiro, you must fill out this form in order to inform the Spanish authorities of the positions you have active as of December 31.

Whether you have one share or thousands of them, its presentation is mandatory. This procedure does not mean the collection of any kind of taxes, it is done for informational purposes only. Today it is possible to complete it and present it completely electronically. The submission date is traditionally between January 1 and 31, although in 2021 the deadline has been extended until February 28 due to technical problems. Any investor who does not present this model is exposed to sanctions and they are not exactly low.

If the authorities are the ones that detect that the model has not been presented even though they have the obligation to do so, the fine is 25% of the undeclared amount with a minimum of 3,000 euros. If it is presented after the deadline, the penalty is 300 euros in the first six months and amounts to 600 euros in the following six.

retail spring

In 2020, according to the balance of the markets operated by the Spanish Stock Exchanges and Markets (BME), the trading volume in Spanish equities reached 429,336.9 million euros, 8.6% less than in 2019. Despite the fall in terms of money, the reality was very different in terms of the number of transactions. Trades for the year as a whole in equities amounted to 55.7 million, which represents a growth of 49.6% compared to 2019. And this growth had a lot to do with a greater influx of small investors who do not hesitate to operate despite have less capital.

Joaquín Robles, an analyst at XTB, says that the firm he works for noticed this increased interest from retailers. “During 2020 we have had very strong growth, in the upper part of the double digits, due to several factors. I think that the first could have been the confinement, many people were confined at home and turned to many online businesses, they caught up on their investments, people who wanted to take time to invest in the Stock Market had it during the confinement and we had many people there interested. Then also the volatility that there was caught the attention of many investors, as well as the sharp falls that gave the opportunity to create portfolios ”, he exposes.

According to XTB results data, the company recorded the highest revenue and profit figure in its history in 2020. With revenues of 178.3 million euros (an increase of 233.4% compared to 2019 figures), and a consolidated net profit of 89.9 million euros (an annual increase of 597.4%). The group managed to incorporate more than 112,000 clients into its firm during 2020, which is 206.5% more than in the previous year. The company currently has more than a quarter of a million customers.

The expert points out that XTB's training channels have experienced a very strong increase in demand, tripling the audience for their courses and multiplying by ten the views of educational videos on YouTube.

Tips for the small investor

If you are a small investor who wants to go it alone, taking into account the fees of the different brokers is even more important. "If the investor wants to go it alone with around 10,000 euros, the right choice depends on how many transactions they plan to make," explains Laurent Amar, co-founder of the HelpMyCash banking product price comparison site. "If there are going to be many, perhaps one that charges less for each one will be preferred," he recommends. Olivia Feldman, co-founder of the same firm, highlights the importance of considering what you want to do before anything else. “If you go little by little, investing month by month, the commissions can eat up more profitability. If you put 100 euros each month and pay 10 commission, it will be very expensive. That is why it is important to understand the commission structure based on how you are going to invest.

The experts at the HelpMyCash banking product comparator advise you to understand very well through whom you are going to operate and to do so only with those products that you really understand how they work. “To decide platform you have to understand two things; first the commissions and second what they give you access to. If there is someone who invests through a broker that charges few commissions, but only gives them access, for example, to shares and not to funds, the type of product is limited, then automatically their capacity for diversification is less and their risk is greater”, he says. Love.

Amar describes the Spanish investment landscape as a somewhat peculiar market. With a lesser tradition of investment in the stock market than other countries and a greater preference so far for the brick, according to the expert, many people have landed on the stock market abruptly. This carries some risks. “It is a market where there is a danger for the consumer or the small saver because there is an imbalance between knowledge and risk. People hear stories that someone has made 300% during Covid and they start investing. People invest in Tesla shares, in Amazon, companies that go up. For now they are lucky. The day there is a problem, an unpleasant surprise can arrive, ”he warns.

banking domain

The two co-founders of HelpMyCash, reflecting on how banked investment is in Spain, argue that many times it is not that the client goes to the bank looking to invest, but that it is the bank that goes in search of the client with propositions. “The bank, in its commercial argument, explains that being a bank it has the best adviser, the best advice, the best analysis department and then it knows what to invest in. When it is shown that profitability is not good, then the answer is 'yes, it seems to you that it is not good, but really what we have done is find the best balance between profitability and risk'. If you look at the profitability and risk of what the banks propose, they rarely win more than the market and they also lose when the market loses”, reflects Amar.

The experts point out that it is not that they do not recommend not investing with the banks, but to do it when it really compensates the investor. "Here the question is whether you want to pay someone to manage your money or manage it yourself. If you want them to manage your shares and someone in the bank is an absolute expert in a sector, maybe it will work out for you. If you are the one in charge to invest, you don't really need the bank and you can do it through a discount broker with low commissions, or even in a bank that makes it cheap for you, there are also banks that allow you to operate at a low price".

In conclusion, the expert says that investing is a good thing, especially if you are young. "When you are young you have the absolute weapon: time. Then, the risk is minimized because if it goes wrong you can wait. You do not have to be a great financial expert, but if you understand more or less what you invest in, you should do well ".

Free broker fever

ascent to the sky

The already historic case of GameStop, with the Reddit forum platform WallStreetBets taking its price to stratospheric levels, put the Robinhood broker in the spotlight, since it was the platform that was initially recommended to use from the Reddit subforum. The volume was such that Robinhood has needed capital totaling $3.4 billion in just over a week to cover trades.

fall to hell

The broker, originally an ally of insiders organized to inflate GameStop's price, soon became an enemy when it froze the game retailer's call options but allowed it to continue selling shares. The reason given was to protect investors from the exceptional market conditions, but it raised suspicions even among United States congressmen when it was revealed that a large part of Robinhood's income comes from the sale of the execution of operations to Citadel, the firm behind of Melvin Capital, one of the funds affected by the GameStop phenomenon.