Home → fancy clothes → What the bank pays f...

What the bank pays for bills and deposits

The return on savings is brighter. But because of his absence. A growing number of banks have joined in pay cuts on time deposits and accounts, which have worsened dramatically over the years as a result of the bce's over-stretching measures to support the economy, even pushing interest rates into negative territory. "Bank profits will only fall, which requires a reduction in the rewards of debt. Quite simply, the account will not be passed on to the bank because the profitability of the bank is very low, "said Joaqu í n Maudos, deputy director of IVIE and professor at the University of Valencia.

Some entities that have recently driven returns have also finally succumbed to a low interest rate environment and announced sharp rate cuts, such as myinvestor, wizink or pibank. Yet while banks pay customers little (or even more), there are still offers that can persist in tapping liquidity without taking any risks.

At the moment, the most interesting advice is not deposits, but accounts, as they allow entities to build more productive relationships with customers and link them to other products. "What financial institutions really make money now is selling related products, such as insurance, cards or investment products, such as funds, and they charge more juicy commissions," said Josepgarc í a, co-founder of Best Bank. Sources in the financial sector said that "banks charge liquidity fees and have no interest in stopping funds, so they prevent deposits".

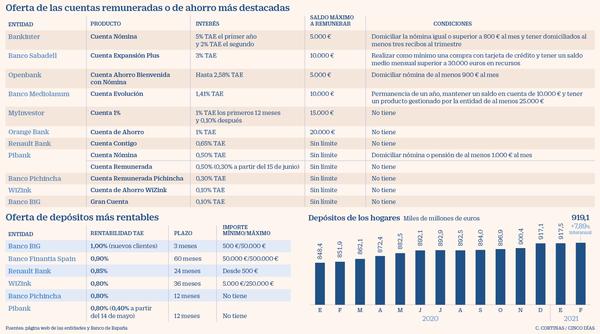

Bankinter is one of a handful of banks to keep account pay unchanged at 5pc tae in the first year and 2pc tae in the second, one of the highest in the market. Therefore, under certain conditions, the maximum can be 350 euros: The minimum requirement is to provide at least 800 euros per month. Entities usually require payment of payrolls in excess of a certain amount, as well as various receipts. OpenBank also requires a minimum income (€ 900 per month) in order to get a 2.58% welcome savings account through the payroll for the first 12 months. Interest rates fell slightly this week after the Santander online agency cut profitability from 0.20 pc to 0.05 pc starting in the seventh month. It remained unchanged at 5% every year for the first six months.

Other institutions are required to maintain an average monthly balance of more than 30,000 euros for Sabadell, adding 3% of the first 10,000 euros to its expanded account. For its part, the medium bank account commits 1.41% tae, assuming it is retained for one year, with a balance of 10,000 euros and products managed by the institution at least 25,000 euros. In addition, it returns 1% of all receipts.

MyInvestor recently reported a decline in profitability for its star accounts. Así, el interés del 1% se mantiene hasta 15.000 euros pero solo durante los primeros 12 meses, en los que el cliente percibe hasta 150 euros brutos en un año. Después, baja al 0,10%. "In the current interest rate environment, no entity can repay savings for a long time without damaging the balance sheet or charging commissions to customers. This is not sustainable, "said the new bank, in which andbankespa ñ a, the UK and axa courts are involved, saying that through this adjustment it" ensures that its business model is sustainable for the long term without commission ". No se exige ninguna vinculación. Por su parte, Orange Bank ofrece un 1% indefinidamente y eleva el límite remunerado a 20.000 euros.

Pibank also recently announced that it will cut interest on its paid account from 0.50% to 0.30% from June 15. However, it won't touch 0.5% of your payroll account, which requires a minimum monthly income of 1,000 euros. For its part, Wizink is informing its former customers that 0.5% interest in their accounts has been reduced to 0.2% from May 1, 2020. Además, las nuevas contrataciones se remuneran al 0,1%.

España, a la cola de la UE con un tipo medio para depósitos del 0,04%, frente al 0,28% de la eurozona

El hachazo en las rentabilidades de las cuentas y los depósitos se intensifica justo en un momento en el que el ahorro de las familias está disparado por la pandemia y alcanza un récord de casi 920.000 millones de euros, según los últimos datos del Banco de España.“Los productos de ahorro en la actualidad remuneran el 0% en la gran mayoría de las entidades bancarias de primer nivel”, declara Eduardo Areilza, senior director de Alvarez & Marsal, y agrega que “las alternativas al depósito al 0% o la cuenta corriente dependen del riesgo que el ahorrador quiera asumir. In fact, zero euro is an acceptable return with zero risk. In any case, the problem lies in the loss of purchasing power.

Parallel commission

The Spanish bank Financial Company stressed that "an increasingly important factor is that in addition to seeking profit, savers must now worry about avoiding costs." In addition to lower rates, the increase in basic service fees in accounts and the fact that some banks (such as ing and bbva) already charge individuals higher savings: Euro30, 000 and Euro100, 000 respectively.

In terms of regular taxation, no Spanish bank currently offers interest exceeding the 1% ceiling. In offers close to that level, the Portuguese-born big bank (Global Investment Bank) pays 1pc, but only to new customers for three months. Banco finantia Spain delivers up to 0.90% over 60 months, with amounts from 50,000 euros. Wizink offers 0.80% tae to 36 months, and Pibank announced it will cut its deposit interest from 0.80% tae to 0.40% to 12 months from May 14. Bank Pichincha maintained 0.80% tae during this period. Joaqu í n Maudos said: "With the continuity of the covid crisis and bce measures, interest rates will remain very low for a long time, which proves that banks are providing less and less deposits." "Banks are now finding it relatively easy to get financing from the central bank. That leaves them generally not interested in getting savings from customers because they have to pay more for that money, "Garcia said.

Britain and bbva have started to collect more private deposits

The most cost-effective options can be found in foreign banks. The Raisin platform allows deposits to be purchased from entities in other European countries up to 1.41%. According to household time deposit rates, the latest figures for February showed Spain at the bottom of the EU rankings at 0.04 pc, compared with the eurozone's average of 0.28 pc.

Considering that the low interest rate scenario will last for several years, the more conservative savings prospects are not optimistic. "This is bad news for savers, but good news for debtors," Maudos stressed, stressing that "the most conservative savers are hurt and if he wants some profits, he has no choice but to take risks." For her part, areilza said, "bce is satisfied with negative types. Many bankers already think that we still have a few years of negative interest rates or close to 0%. For example, if the current saving shifts rapidly to consumption, it may change the strategy. "

Ganchos en efectivo como alternativa

Atraer nóminas. As an alternative to payroll interest, some banks seek to remain competitive with other links. Santander offers 100 euros in cash with a minimum income of 600 euros and stays with the institution for one year. Promotions can now be rented in the office. Deutsche Bank's payroll plus db account offers bonuses of up to 480 euros (20 euros per month for two years) to new customers who sign up through online channels if they hold at least 1,500 euros per month and use a card to buy. Liberbank pays 150 euros in cash to people with payrolls equal to or higher than 600 euros. ABACA pays a 150 euro payroll in a clear account. Your bbva account pays at least 800 euros per month for a payroll of 100 euros. Targobank provides screen breakage insurance for your phone for six months, up to 60 euros for your next account.